Family Law

Private Client

Conveyancing

PERSONAL LEGAL SERVICES

Administering a death estate when there’s a Will

When administering the estate of someone who has died, the process can be different depending on whether the person who has died made a Will. Where the is a valid Will then you may need a Grant of Probate to enable you to properly administer the estate and transfer assets to the beneficiaries. the type and value of the estate assets will have a bearing on whether you need to apply to the Probate Registry for a Grant of Probate, they will also determine whether the estate is liable to pay inheritance tax. At Frodshams our solicitors are trained to help you navigate the relevant legal process in what can be one of life’s most difficult times.

Estate Administration Guide

Simply click on a heading below to find out more.

ESTATE ADMINISTRATION GUIDE

Glossary

Legal jargon can make an already complicated process like probate feel even more daunting. That's why we've created this Probate Glossary - to help you make sense of the terms and phrases you're likely to encounter. Consider this your go-to resource for understanding the language of probate, so you can navigate this journey with greater clarity and confidence.

Definition: Executors and Administrators are individuals or institutions responsible for settling the deceased’s estate. Executors are named in a will, while Administrators manage estates where no will exists or no executor has been designated.

Definition: Beneficiaries are the individuals or entities named in a will to receive assets or property from the deceased’s estate.

Definition: A Personal Representative is a broad term that refers to either an Executor or an Administrator. This person is responsible for overseeing the distribution of the estate according to the will or, in the absence of a will, according to the law.

Definition: A Grant of Probate is the legal document that authorises the Executor to manage and distribute the deceased's estate as specified in the will.

Definition: This is a general term used to describe the legal authority to administer someone's estate. It encompasses both Grants of Probate and Letters of Administration.

Definition: A Probate Solicitor is a legal professional specialising in probate law. They offer expertise in the legal processes involved in administering a deceased person’s estate.

Definition: The Estate, or Assets, refers to all property, financial accounts, debts, and obligations that a person had at the time of their death.

Definition: 'Testate' refers to dying with a legally valid will. 'Intestate' refers to dying without a will, resulting in the distribution of the estate according to the laws of intestacy.

Definition: Inheritance Tax is a tax levied on the value of the deceased’s estate above a certain threshold. The tax is payable before the estate can be distributed to the beneficiaries.

Definition: This is the legal authority granted to Administrators to manage and distribute an estate where no will exists or where no Executor has been named.

Definition: This is a legal document that grants someone the authority to act on another person’s behalf, particularly relevant if the deceased had one in place for healthcare or financial decisions.

Definition: A Codicil is a legal document that modifies, deletes, or adds to the content of an existing will.

Definition: The Probate Registry is the judicial body where you apply for a Grant of Probate or Letters of Administration.

Definition: This refers to the entire process of managing and distributing a deceased person's estate. It includes collecting assets, paying off debts, and disbursing inheritances, among other responsibilities.

Definition: These are the statutory rules that dictate how an estate will be divided when someone dies without a will ('intestate'). The distribution is typically among close relatives, such as spouses, children, and parents.

Definition: A Will is a legal document outlining how a person wishes their assets and property to be distributed after their death.

Definition: This term refers to a specific gift of money or assets left to a beneficiary in a will.

Definition: A Trust is a legal arrangement where assets are held by one party for the benefit of another. Trusts may be used in estate planning to manage how assets are distributed after death.

Definition: This is an official appraisal of the estate’s assets, often necessary for calculating Inheritance Tax and for providing an accurate account to beneficiaries.

Definition: A Probate Caveat is a legal notice preventing the grant of probate or administration for a specific period, often because of a dispute or claim against the estate.

Definition: This is a legal document that allows beneficiaries to change their entitlement from a will or under the rules of intestacy, often for tax planning or fairness.

Definition: An Affidavit is a sworn statement, often used in probate to confirm certain details about the deceased or their estate.

Definition: A Guardian is an individual appointed to care for any minor children if both parents are deceased.

Definition: This refers to a fixed sum of money left to a specific beneficiary in a will.

Definition: A Specific Bequest is a particular item, such as jewellery or a piece of art, left to a designated beneficiary in a will.

Definition: This term refers to what remains of the estate after debts, expenses, and specific bequests have been fulfilled. It is usually distributed among beneficiaries according to the proportions specified in the will.

Definition: These are the legal responsibilities that an executor must perform when administering an estate, including obtaining a Grant of Probate, collecting assets, paying debts, and distributing the estate.

Definition: Similar to Executor's Duties, these are responsibilities an administrator must perform but occur when there is no will, or the executor named in the will cannot act. Duties include obtaining a Grant of Letters of Administration, paying off debts, and distributing the estate according to intestacy laws.

Definition: These are claims made against the estate by close relatives or dependents who believe they should receive a portion of the estate or a larger share than they were allotted in the will.

Definition: This is the official document confirming the details of an individual’s death. It is often required when initiating the probate process.

Definition: These are the costs involved in administering an estate, which may include court fees, valuation fees, and solicitor’s fees.

Definition: This is a form of property ownership where multiple people own an asset together. When one owner dies, their share automatically passes to the surviving owners.

Definition: Another form of property ownership, but unlike joint tenancy, each owner’s share can be left to beneficiaries in a will rather than automatically passing to the other owners.

Definition: A Life Interest gives a beneficiary the right to use an asset (like a house) or receive income from an asset (like an investment) for their lifetime, after which it will pass to other beneficiaries.

ESTATE ADMINISTRATION GUIDE

Understanding when probate applies

Determining whether probate is required can be confusing. Here's a guide to help you understand when it's typically needed and when it might not be:

There's a will, and you're named as an executor:

If your loved one left a will and appointed you as the executor, probate is usually required to validate the will and give you the legal authority to administer their estate.

The estate includes assets solely owned by the deceased:

If your loved one owned property, land, or significant financial assets in their sole name, probate is typically needed to transfer ownership of these assets to the beneficiaries.

The estate's value exceeds £5,000:

In England and Wales, estates valued above £5,000 generally require probate. However, this threshold can vary depending on the specific assets and financial institutions involved.

Jointly owned assets:

If assets were held jointly with another person as joint tenants, those assets automatically pass to the surviving owner(s) upon death. This includes jointly owned property, bank accounts, and investments.

Assets with named beneficiaries:

Pensions, life insurance policies, and some bank accounts often allow the account holder to name a beneficiary. In these cases, the assets usually pass directly to the named beneficiary without the need for probate.

Small estates:

Some smaller estates might not require probate if the value falls below a certain threshold. However, it's always best to confirm this with a legal professional, as the rules can vary depending on the specific assets involved.

Complex estates:

If the estate involves multiple beneficiaries, complex assets (such as businesses or foreign properties), or potential for disputes, probate can provide a valuable legal framework for managing the estate and resolving any issues that may arise.

Protecting beneficiaries:

Probate can shield beneficiaries from potential claims against the estate by ensuring that all debts are settled before assets are distributed.

Legal clarity:

The probate process provides a clear legal record of the estate administration, reducing the risk of future disputes and providing peace of mind for everyone involved.

At Frodshams, we understand the complexities of probate and can guide you through the process, ensuring a smooth and stress-free experience. Whether your situation is straightforward or requires expert navigation, our team of compassionate and expert probate solicitors are here to guide you every step of the way.

Contact us for a free, personalised consultation to discuss your specific needs on 01744 626 600 or use our other contact methods here.

ESTATE ADMINISTRATION GUIDE

Common Probate Scenarios

We understand that every estate is unique. To help alleviate some of that uncertainty, here are some common scenarios we often encounter, along with how our expert probate solicitors can assist you:

Whether your situation fits into one of these scenarios or not, rest assured that you're not alone and we're here to help.

If the deceased owned their own home, probate is usually necessary to transfer the property or sell it. Even if the home was co-owned, unless it was held as “joint tenants,” probate will still be required to determine the rightful heirs.

When an individual has an estate comprised of high-value assets like businesses, investments, or intellectual property, the probate process can be more complicated. These types of assets often require specialised appraisals and may involve complex tax considerations.

Assets owned jointly typically pass directly to the surviving owner and usually don’t go through probate. However, the type of joint ownership matters. “Joint tenancy” assets pass directly to the co-owner, while “tenancy in common” assets do not.

In cases where the deceased didn’t own many assets, or their estate is considered “small” under the law, you may be able to use a simplified probate process or even skip probate altogether. However, the rules for what constitutes a “small estate” can vary.

If the deceased owned assets in multiple countries, international laws could affect the probate process. Handling estates with international assets usually requires expertise in various jurisdictions’ legal systems.

Dying without a will, or “intestate,” triggers a set of statutory rules that dictate how the deceased’s assets will be distributed. This can be a longer and more complex process, especially if there are multiple potential heirs.

In modern families, it’s not uncommon for families to be composed of step-children, half-siblings, and other blended relationships. This can add complexity to probate, especially if the will is not clear on how assets should be divided among these family members.

If the deceased was a business owner, the business’s disposition may require a separate set of probate proceedings, depending on how the business was structured and owned.

No matter your situation, our team of professional and compassionate probate solicitors is here to help. We'll tailor our approach to your specific needs, ensuring a smooth, efficient, and stress-free probate experience. Contact us today for a free consultation to discuss your situation and learn how we can support you.

ESTATE ADMINISTRATION GUIDE

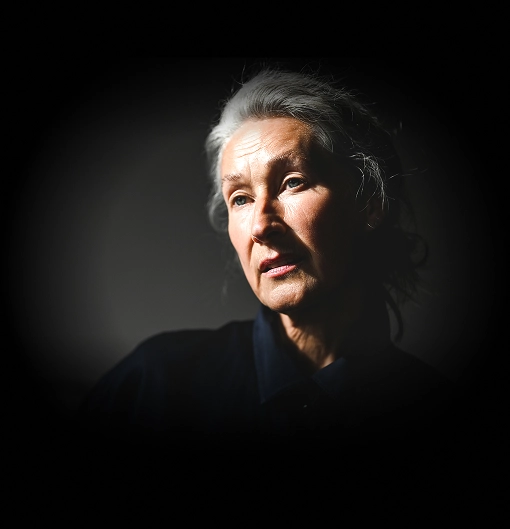

Your team of professional, experienced probate solicitors

Navigating probate can be complex and emotionally draining. The stakes are often high, both emotionally and financially. It's crucial to have a team you can trust - especially when it comes to legal representation.

Our team is helmed by our Partner, Kirsty Strong, who has been specialising in this area since 2009. Kirsty has extensive experience in handling complex estates, contested wills, and international probate matters. She's committed to providing compassionate guidance and tailored solutions to each client.

Working alongside Kirsty is our Senior Partner, Amanda Woods, who brings over 20 years of experience serving the elderly and vulnerable. Amanda's in-depth understanding of the unique needs of this community ensures that our services are always sensitive and supportive.

Tailored, Compassionate Service: Unlike large, impersonal firms, we provide a personalised approach that prioritises your individual needs and circumstances. We understand that probate is a deeply personal matter, and we're here to offer both legal expertise and emotional support.

Comprehensive and Up-to-Date Knowledge: All our probate solicitors are dedicated to maintaining their expertise through ongoing professional development. We stay abreast of the latest changes in probate law and best practices to ensure you receive the most accurate and up-to-date advice.

Transparent Pricing: We believe in transparency and will provide you with a clear understanding of our probate pricing upfront, so you'll never encounter any unexpected costs.

The Extended Team: Our team extends beyond our solicitors. We also have a dedicated team of legal assistants who handle day-to-day tasks on cases, ensuring a smooth and efficient process for our clients.

No-Obligation Consultation: Want to speak to us? We offer a no cost, no obligation 30-minute consultation. During this session, we can discuss your specific needs, potential complexities, and how a Probate Solicitor at Frodshams can support you through this challenging process. Contact us today to schedule your free consultation and learn more about how we can assist you in your probate journey.

The Benefits of Choosing Frodshams for Probate

Handling probate during a difficult time can be overwhelming. While you're not legally required to hire a solicitor, partnering with our experienced probate team at Frodshams can make a world of difference.

Probate can sometimes lead to disputes among beneficiaries, especially when the will is not entirely clear. We'll work proactively to resolve any potential conflicts between beneficiaries, ensuring a smooth and fair distribution of assets.

Our solicitors have in-depth knowledge of probate law and can anticipate challenges, saving you from costly mistakes and delays.

We'll be your trusted partner throughout the process, providing clear explanations, expert advice, and compassionate support every step of the way.

We meticulously handle all paperwork and deadlines, ensuring your loved one's estate is settled correctly and in accordance with the law.

We’re more than just experts in law; we’re people who care. At Frodshams, you’re not a case number; you’re an individual going through a tough period, and we’re committed to easing that journey for you.

The probate process can be lengthy and time-consuming, especially if you're unfamiliar with the steps involved. Our solicitors take care of the complexities, allowing you to focus on what matters most during this difficult time.

Choosing to work with our Probate Solicitors can transform a daunting task into a manageable process, offering peace of mind during a period where emotional and mental resources are often already stretched thin. Feel more confident in navigating probate by reaching out to us today for a no-cost, no-obligation 30-minute consultation.

KIRSTY STRONG

HEAD OF PRIVATE CLIENT

TO CONTACT KIRSTY PLEASE

CALL01744 626 600

EMAILinfo@frodshams.co.uk

“Our goal is to simplify the process and ease your stress so you feel confident and cared for every step of the way.”

Our dedicated team brings extensive experience in supporting clients and their families through the legal process during some of life’s most trying moments. Led by our Private Client Partner, Kirsty Strong, who has been specialising in this field since 2009, our team handles even the most challenging and intricate cases with professionalism and care. We are here to provide guidance and expertise every step of the way.

TO CONTACT KIRSTY PLEASE CALL01744 626 600

EMAILinfo@frodshams.co.uk

To find out more, speak to us on

01744 626 600 or email

“Would like to thank Frodshams for making a difficult time so easy when applying for a grant ofprobate after the death of my Mother from filling in forms, gathering evidence and super communicationwhen need emails and phone calls highly recommended.”

Mrs Purcell (CM)

CLIENT FEEDBACK